K Symbiosis Institute Of Management Studies

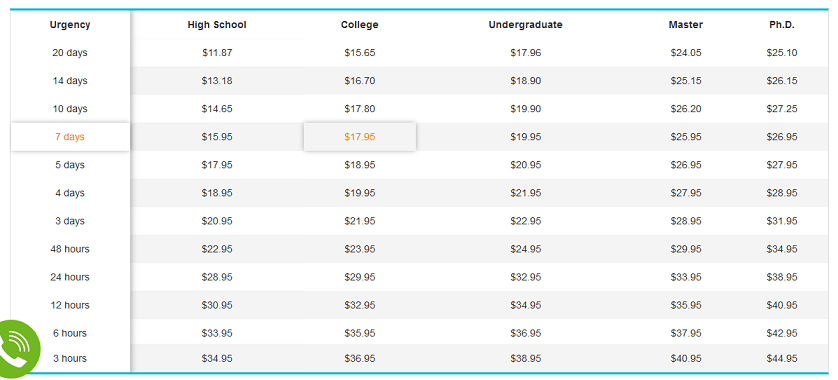

· Goods and Services Tax (GST) is a reformatory legislation which is a single tax on the supply of goods and services, right from the manufacturer to the consumer. Credits of input taxes paid at each stage will be available in the subsequent stage of value addition, which makes GST essentially a tax only on value addition at each blogger.comted Reading Time: 8 mins Get Your Custom Essay on Goods and Services Tax Analysis For as little as $15/Page Order Essay In recent months there are a lot of issues about many retailers especially the traditional retailer want to quit from their business. Their main reason is the launch of the Goods [ ] +1() Goods and Services Tax (GST) or Value Added Tax (VAT) is a consumption tax imposed on the sale of goods and services. The Malaysian government introduce this potential tax mechanism, in order to increase the existing tax bracket and replacing the

Search by one word

· Goods and Services Tax (GST) Introduction Goods and Service Tax is a tax on goods and services, which is leviable at each point of sale or provision of service, in which at the time of sale of goods or providing the services the seller or service provider can claim the input credit of tax which he has paid while purchasing the goods or procuring the service · Goods and Service Tax (GST) is a value-added tax that is levied on most goods and services sold for domestic usage. GST is included in the final price and paid by the consumers at the point of sale, and it is passed to the government, GST provides revenue to the government. It is the common tax used by the majority of countries globally Goods and Services Tax. Published Date: 23 Mar Disclaimer: This essay has been written and submitted by students and is not an example of our work. Please click this link to view samples of our professional work witten by our professional essay writers. Any opinions

Essay Fountain

Get Your Custom Essay on Goods and Services Tax Analysis For as little as $15/Page Order Essay In recent months there are a lot of issues about many retailers especially the traditional retailer want to quit from their business. Their main reason is the launch of the Goods [ ] +1() Goods And Services Tax (Gst) Essay Words | 8 Pages. Goods and Services Tax (GST) is a wide-ranging tax levy on manufacture, sale and consumption of goods and services at a national level. One of the biggest taxation reforms in India the (GST) is all set to integrate State economies and boost overall growth · Goods and Services Tax (GST) is a reformatory legislation which is a single tax on the supply of goods and services, right from the manufacturer to the consumer. Credits of input taxes paid at each stage will be available in the subsequent stage of value addition, which makes GST essentially a tax only on value addition at each blogger.comted Reading Time: 8 mins

Important Links

Get Your Custom Essay on Goods and Services Tax Analysis For as little as $15/Page Order Essay In recent months there are a lot of issues about many retailers especially the traditional retailer want to quit from their business. Their main reason is the launch of the Goods [ ] +1() · Essay on Goods and Services Tax (GST) Essay on GST With Headings. By reducing the cascading of tax at numerous levels, GST offers the goods more affordable Laws of GST. Here, Central GST Law administers with the combination of all taxes on goods and services, their Benefits of GST. The primary Estimated Reading Time: 7 mins Goods And Services Tax (Gst) Essay Words | 8 Pages. Goods and Services Tax (GST) is a wide-ranging tax levy on manufacture, sale and consumption of goods and services at a national level. One of the biggest taxation reforms in India the (GST) is all set to integrate State economies and boost overall growth

Get Daily Updates

· Essay on Goods and Services Tax (GST) Essay on GST With Headings. By reducing the cascading of tax at numerous levels, GST offers the goods more affordable Laws of GST. Here, Central GST Law administers with the combination of all taxes on goods and services, their Benefits of GST. The primary Estimated Reading Time: 7 mins Goods And Services Tax (Gst) Essay Words | 8 Pages. Goods and Services Tax (GST) is a wide-ranging tax levy on manufacture, sale and consumption of goods and services at a national level. One of the biggest taxation reforms in India the (GST) is all set to integrate State economies and boost overall growth Goods and Services Tax (GST) or Value Added Tax (VAT) is a consumption tax imposed on the sale of goods and services. The Malaysian government introduce this potential tax mechanism, in order to increase the existing tax bracket and replacing the

No comments:

Post a Comment